Research shows major retailers employ 3500-4000K color temperatures, a strategic lighting choice that leverages powerful psychological mechanisms to influence shopping behavior, with documented sales increases of 2-20% and typical investment payback periods under three years.

The Real Numbers Behind Retail Lighting Strategies

Major retailers have indeed revolutionized their lighting approaches, with actual specifications telling a nuanced story about strategic illumination. Target's partnership with Acuity Brands has deployed over 2 million LED fixtures across 1,800+ stores, standardizing around 3500-4000K color temperatures for general lighting—neutral to cool white that creates an energetic shopping environment without venturing into harsh, uncomfortable territory. Walmart's LED initiatives, implemented with GE Current, follow similar parameters, using 3500K for warm areas and 4000K for standard retail spaces, with specialized applications reaching 5000K maximum for enhanced visibility in specific departments.

The grocery sector pushes slightly cooler, with refrigerated display cases using 4000-5000K to enhance product freshness perception, while fashion retailers typically stay warmer at 3000-3500K to flatter skin tones and create more intimate shopping experiences. Even the brightest retail environments—exemplified by Apple stores that pioneered the ultra-bright aesthetic—max out around 5000-6500K. Industry standards have converged on these ranges for good reason: they balance customer alertness with comfort, avoiding the extreme blue light exposure that would trigger the physiological stress responses associated with true daylight-equivalent color temperatures.

How Bright Lighting Hijacks the Shopping Brain

The behavioral science behind retail lighting reveals sophisticated psychological manipulation operating largely below conscious awareness. Research by Harvard and neuromarketing experts confirms that 95% of purchasing decisions occur unconsciously, making environmental stimuli like lighting powerful tools for influencing behavior without customers' explicit awareness. When shoppers enter brightly lit stores with 4000K lighting, their brains respond with measurable changes: increased cortisol production heightens alertness, melanopsin receptors in the eyes trigger arousal responses, and the stimulus-organism-response pathway activates approach behaviors that keep customers engaged longer.

The seminal Areni & Kim wine store study demonstrated that brighter lighting caused customers to handle significantly more merchandise, while subsequent research by Summers & Hebert found shoppers spent considerably more time at brightly lit displays. A Swedish Royal Institute study with 97 participants revealed that cool color temperatures create perceptions of wider, more spacious areas—a psychological trick that makes stores feel less cramped and more inviting. The Quartier supermarket simulation study showed that lighting alone could communicate store image and influence approach-avoidance behavior without any other atmospheric changes, confirming that light operates as a powerful subconscious influence on shopping patterns.

Most remarkably, eye-tracking research from Hamburg University found that shoppers' eyes are drawn to areas of contrast rather than uniform brightness, with blue-enriched light attracting more attention than any other color—explaining why retailers use strategic accent lighting on high-margin products while maintaining moderate ambient levels. This creates what researchers call "visual hierarchy," guiding customers through stores along predetermined paths that maximize exposure to promotional items and impulse-purchase opportunities.

The Measurable Impact on Buying Behavior

Hard data from controlled studies reveals stunning returns on lighting investments that extend far beyond energy savings. Giant Eagle's year-long study of LED checkout lighting across eight Pittsburgh stores documented a 20% sales increase at point-of-purchase displays—results so compelling that Hershey and Wrigley funded nationwide expansion. A Dutch supermarket's split-store comparison tracked individual shopping baskets for 21 weeks, finding the LED-lit section achieved 2% more products sold per customer through extended dwell time alone.

The German fashion retailer Gerry Weber increased lighting from 450 to 600 lux with strategic accents, achieving a 12% sales increase while simultaneously reducing measured customer stress levels. Convenience stores report even more dramatic results, with on-shelf lighting generating 5-7% sales increases consistently across multiple chains, and some locations documenting up to 20% increases at checkout areas with just 54-day payback periods on $7,000 investments.

Research from the Lighting Research Center at RPI found customers willing to pay higher prices for products in well-lit stores and selecting twice as many items from shelving with integrated lighting. The psychological mechanism appears straightforward: bright, cool lighting increases arousal and energy levels, making customers more likely to engage with products, while improved visibility reduces the cognitive effort required to evaluate items, lowering psychological barriers to purchase. Department of Energy studies confirm these effects scale across entire stores, with one ENERGY STAR analysis finding LED conversions increased grocery sales by an average of 19%.

The Dark Side of Bright Retail Spaces

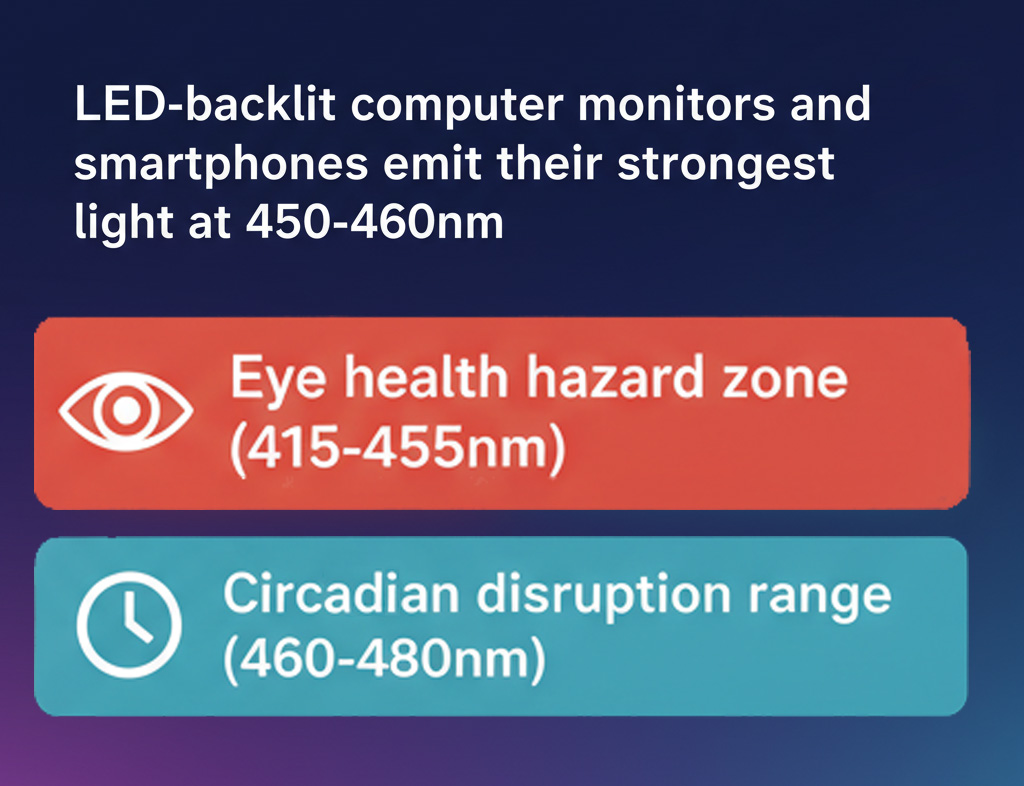

While retailers celebrate sales increases, the physiological toll of bright, blue-enriched lighting on shoppers and employees raises legitimate health concerns. Harvard research demonstrates that blue light wavelengths between 460-480nm—abundant in 4000K+ LED lighting—suppress melatonin production for twice as long as green light, shifting circadian rhythms by up to three hours. This disruption extends beyond simple sleep disturbance: melatonin suppression affects immune function, antioxidant activity, and hormonal balance across multiple glands including the thyroid, pancreas, and adrenals.

Survey data reveals 33% of people experience severe functional limitations under bright LED and fluorescent lighting, with 56% reporting headaches and 85% of light-sensitive individuals forced to wear sunglasses while shopping to reduce discomfort. The symptoms read like a medical chart: eye strain, fatigue, dizziness, difficulty concentrating, anxiety, and visual disturbances that persist hours after exposure. France's ANSES agency has highlighted both short-term retinal effects and long-term macular degeneration risks from intense blue LED exposure, while the American Medical Association expressed formal concern about LED lighting having "5 times greater impact on circadian sleep rhythms than conventional lighting."

Customer backlash manifests in avoidance behaviors, with light-sensitive shoppers—including the 80-90% of migraine sufferers who experience photophobia—actively avoiding stores with harsh lighting. Hospital workers report daily headaches from similar lighting conditions, suggesting that retail employees face chronic health impacts from all-day exposure. The neurological pathways from eyes to brain that respond negatively to blue wavelengths can trigger headaches, anxiety, and sensory overwhelm, creating shopping experiences that drive customers away despite retailers' behavioral manipulation attempts.

Following the Money Behind Lighting Upgrades

The business case for bright retail lighting extends far beyond the widely touted energy savings, revealing ROI figures that explain the rapid industry-wide adoption. Typical LED retrofit projects achieve payback periods of 6 months to 3 years, with some convenience store installations recovering costs in just 54 days. A comprehensive analysis of 15 major retailers by the Department of Energy's Better Buildings Campaign documented $68 million in annual energy savings from 2.8 million fixture upgrades, but these operational savings pale compared to sales impacts.

The financial benefits cascade through multiple revenue streams: impulse purchases increase under enhanced product visibility, premium products sell better with improved color rendering, and specific category performance improves with targeted lighting—health and beauty sections report 6% increases while promotional areas see up to 15% growth in customer visits. Beyond direct sales, operational benefits multiply returns through 80% maintenance reduction, decreased shrink rates correlated with better visibility, and 15% improvements in employee alertness that boost productivity.

Utility rebate programs accelerate payback by 25-30%, with typical incentives of $25-50 per LED fixture improving project ROI from 19.5% to 25.1% in documented cases. When compared to traditional store improvements like floor renovations ($100,000+ with uncertain returns) or fixture replacements (high cost, minimal customer impact), lighting upgrades deliver the highest ROI in retail improvement hierarchies. One educational facility documented 115% annual ROI increases, while industrial applications report similar triple-digit returns, explaining why the global commercial LED lighting market is projected to grow from $17.07 billion in 2024 to $27.38 billion by 2030.

Where Retail Lighting Heads Next

The industry is rapidly evolving beyond simple bright-and-cool approaches toward sophisticated human-centric lighting (HCL) systems that balance sales objectives with customer wellbeing. The HCL market, exploding at 29.4% annual growth, represents retailers' recognition that overwhelming customers with harsh lighting ultimately undermines long-term loyalty. Smart lighting systems projected to reach $17.38 billion by 2030 enable dynamic adjustments throughout the day—cooler temperatures in morning hours when natural cortisol is high, warmer tones in evening to avoid circadian disruption.

Tunable white LEDs allow retailers to shift between 3000K and 5000K based on time, weather, or promotional needs, while zone-based strategies apply different lighting approaches to different store areas—bright and energetic in high-traffic zones, softer and warmer in decision-making areas like fitting rooms. IoT integration enables real-time adjustments based on occupancy patterns and customer flow, with edge AI systems predicting optimal lighting conditions for maximum sales while minimizing physiological stress.

Quantum dot technology promises 20% efficiency improvements while expanding displayable colors by 50%, potentially allowing retailers to enhance product appearance without extreme brightness. Li-Fi integration could transform store lighting into data transmission networks, while UV disinfection capabilities address post-pandemic hygiene concerns. The "Apple Effect" that drove the industry toward bright, minimal aesthetics is giving way to more nuanced approaches, with luxury retailers like Estee Lauder and DKNY employing lighting designers who emphasize emotional connection over raw brightness.

Conclusion

The retail lighting revolution represents a fascinating intersection of behavioral science, business strategy, and public health concerns. The actual 3500-4000K standards exert powerful psychological influences that boost sales by leveraging unconscious decision-making processes. The documented ROI makes bright lighting investments nearly irresistible to retailers, yet growing awareness of health impacts and customer comfort is driving evolution toward more sophisticated, adaptive systems that balance commercial objectives with human wellbeing. As the industry moves toward human-centric, dynamically adjustable lighting, the future of retail illumination lies not in overwhelming brightness but in intelligent systems that optimize the shopping experience while respecting the physiological and psychological needs of both customers and employees.